03 Jun LVMH

Paris Luxury industry

Louis Vuitton Moët Hennessy 30 Avenue Hoche, 75008 PARIS FRANCE Contact: 01 44 13 2222 Sealed: July 8th, 2020 CITY: PARIS RUE MONTAIGNE

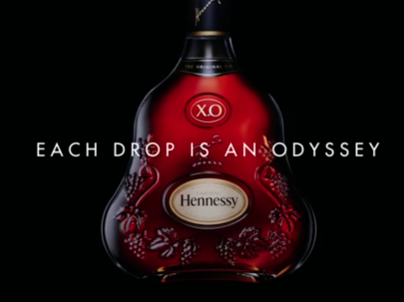

Paris net sales break down by family of products as follows: - fashion and leather goods (48.9%): - wines and spirits (7.7%): - perfumes and cosmetic products (9.6%): - watches and jewelry (12.7%): - Distribution (20.6%) by 5,664 stores early 2023. The geographical breakdown of sales is as follows: France (7.9%), Europe (16.4%), Japan (7.3%), Asia (30.8%), United States (25%) and others (12.3%). Early 2025, employees vol: 192 000¹.

Microeconomics

Soon available

Learn more about Reporting violation >

Paris is a French group of companies resulting from the merger in 1987 of the entities Moët Hennessy and the manufacturer Louis Vuitton, its majority shareholder being the Christian Dior holding company. The listed company has a portfolio of more than seventy prestigious brands in the field of wines and spirits, as well as in the field of fashion and jewelry. It is also present in the media, distribution, and luxury hotel industries. President Thomas Jefferson and Voltaire¹² are two of the most important historical client³. Natalie Portman, Marion Cotillard, Charlize Theron, JBL and Cara Delevingne have notably worked for Dior. Main competitors are Richemont S.a and Kering S.a. With the notable exception of Christian Lacroix, personal property of the CEO when it was created, the group’s goal is clearly to buy brands rather than found them, then to multiply the synergies between them. Vanguard own 1.53% of the group on January 8, 2020. Between January 2017 and June 4, 2020, Paris went from a capitalization at 123.187 to 203.601 M€ spread over more than 500,000 shares for a reference price of 404 €. However, during the pandemic, the market split the title by a third of its value. Despite the events relating to the first quarter which slowed down sales and halted logistics flows between shops and factory production, net debt should continue to resorb by a quarter compared to 2020 and turnover should continue to grow. This stability seems predictable by crossing health political and justice fields. So, it is necessary to observe any data to try to understand the short term future of the luxury industry and speculate when sell and buy stocks.

How NYP assesses private sector Browse >

-

- Intrication

- Pray

- Last PoW

First, due to the health policy contrasted by its observe lethality rate, the concerns of consumers and employees of Paris has turned towards the return to a normal life. Few individuals consider themselves to be survivors of a modern black plague and in the absence, of this psychological stigma closing in on the essentials, the markers of social status of luxury prevail again in society as evidenced elsewhere , the spectacular recovery of the LVMH share. In 2020, some says it could still be a short-term rebound effect. However, the internal indices provide elements of a contradictory response. Thus, the reason Paris exists is to grow. The board of directors will obviously have to treat the 2020 financial year as a useful buffer period for understanding the legal ecosystem of the consortium in a health crisis. Indeed, maintaining the profitability of a non-essential business during a crisis imposed on it requires reducing debt. In the case of the March 2020 epidemic, the turnover for the 1st quarter is lower than the forecast for 2019 but the results of the last 3 quarters were sufficient to make up for the shortfall. With an P3 outbreak, the same constants would not be observed. So a statistical model must deduce from which epidemiological moment, the title becomes unchanged. This window of appearance can be narrowed down by the analysis of local public health measures, but the forecasting model cannot be analyzed without a profound change in international regulation.

Second, the judge's decisions are binding on the public sector. A conviction that has become final can decrease the productivity of a company, the importation of its products, and increase the debt through payment. As the first factor of retained on the divides, the payment of the convictions become final. In tax matters, a dispute between Paris and a recovery ended up in January 23,2020 by the Cour de cassation with a decision against the State¹ body. Paris hold here an exemplary behavior. Before that, on January 26, 2012 on the related ground of the illicit agreements and anti-competitive practices, a court of appeal had condemned a distributor customer of Paris under the French Commercial code because of a participation in a price police put in placed by the suppliers for the years 1997 to 1999. On June 11, 2013², the supreme court had partially dismissed the appeal brought among other part Paris, it even under the influence of a pecuniary sanction emitted by the council of competition¹ for an amount distributed of 46 M€. For the French media³, the absence of competition organized by the agreement between the producer and its distributors, allows everyone to increase and then share, the surplus obtained to the detriment of the consumer. Since then, no court decision has supported new similar facts. Then, according to the principle of non bis in idem, Paris can no longer be the subject of sued - except discovery of new, serious and concordant elements - which deprives the entity of consideration harmful to its rating in the section of reiteration. This principle does not preclude other similar investigations. It is possible to cite the Decision n ° 15-DCC-139 of October 20, 2015 relating to the exclusive control of the publishing activity and marketing of the newspapers Le Parisien and Aujourd’hui en France, the operation of which was judged to be incapable of damaging competition through conglomerate effects⁴. It is also possible to cite the Christian Dior vs TUK judgment of 14 December 2000⁵. In both cases, the disputes raised around Paris have made it possible to clarify notions of applicable law which makes it a precursor clearing the way for society and not, an offender who plays against it. Thus, although all litigation¹²³ listed are varied, none can to date the value attributable to the options issued by Paris and it is in light of its historical performance, that we must look at the fall of fiscal year 2020 as a punctual event.

For these reasons,

Paris deserves the highest confidence.

Last tenders in Paris ( IDF )

| Paris | CHRISTIAN LOUBOUTIN | 19 rue Jean Jacques Rousseau 75001 Paris FRANCE | |||

| Boulogne | ARCHITECT | 18 Rue Barthelemy Danjou 92100 Boulogne-Billancourt FRANCE | |||

| Courbevoie | THALES | 31 Place des Corolles, 92400 Courbevoie FRANCE | |||

| Vitry Gare | HAIR DRESSER | 13 Av. Paul Vaillant Couturier 94400 Vitry France |

No Comments