30 Dec AFM

Roubaix Holding

AFM. Intentionally left blank 59100 Roubaix FRANCE Unsealed: July 18, 2020 CITY: ROUBAIX HAUTS DE FRANCE

Microeconomics

Soon available

Learn more about Reporting violation >

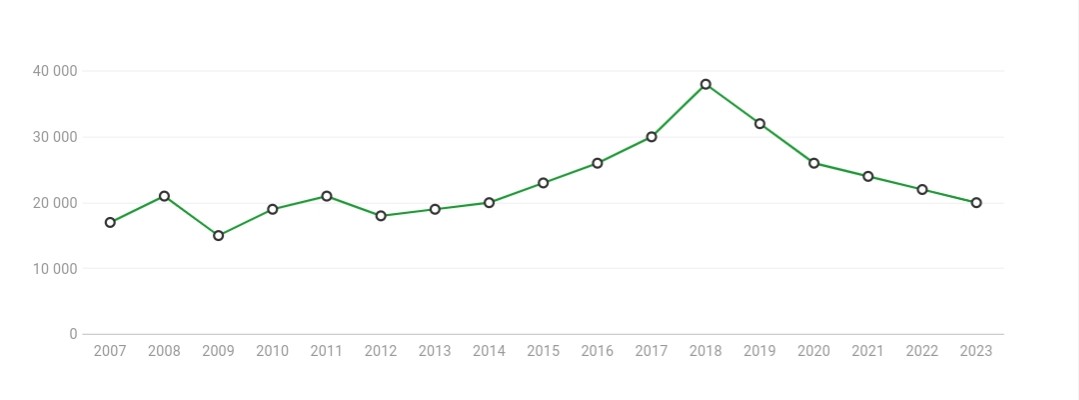

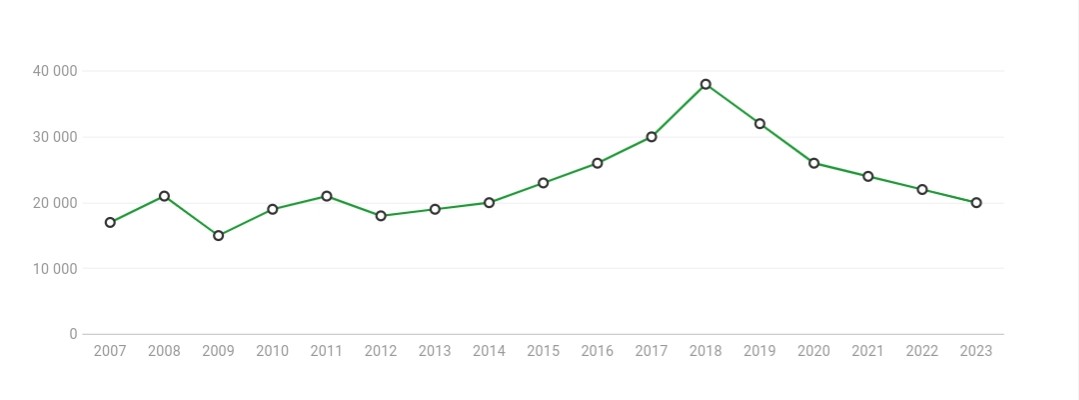

Any French born after WWII knows at least one company founded under the influence of Roubaix. This makes them the most powerful private interest group in northern France. Yet, as only few details disseminate in the public space so, an immense majority of people ignore everything of the mechanism of gearing at work behind the big signs. This refers to the speech of Flanders in 2019, where the emeritus presidency of the family group recalled the importance of training for both employees and heirs. But how to defend the need to inform when one prone "the cult of discretion". One could deduce that for Roubaix, individuals do not have the means to deal with all truths. Moreover, Roubaix reminds that in a world where the media would let down bad news in favor of positivism, the Haut-de-France would exceed the other regions of France. Now, if the individual is not able to recognize the truth, how could he/she decide more wisely for the group, once formed? This current of thought imbued on the work of Thomas Hobbs¹, 17th century always finds the ontological limit and which takes in a quote from Condorcet¹: "to say that the people know enough if they know how to want to be free, is to admit that we wants to deceive them to become master of it ”. On the other hand, in the same speech, Roubaix delivers a significant analysis on the incentive of permaculture, the automation of drive-thru, the reasons for French incompetitiveness especially against Amazon. In a world made more liberal than in the past, public health policy has hit provisional results of the private sector, weakening the speculation tools of previous models and even redistributing business opportunities. So, it is pregnant to confront Roubaix with the yardstick of law and medicine.

How NYP assesses private sector Browse >

Credits: L'obs, Challenge and FBC

-

- Intrication

- Pray

- Last PoW

In the first place, the decisions of judge are imposed on Roubaix which has an impact on the operating results of the group and than, the revenues paid to shareholders. This is the case of the financial judge who squelch any breach of tax policy. Even if this last seriously harms the competitiveness of the private sector of the European Union as argued Roubaix. The shareholder concerned with anticipating what will happen should therefore be interested in the legal background of the group. Independently of the US SEC, it has been prolific. Roubaix links many relations with the local courts, which is a perfectly benign symptom for a company of this size. Requirements for telecommunication networks, social plans, CNIL data management¹. It seems that Roubaix was perfectly acclimatized to positive law with regard to two distinct elements; the first procedural element allows the group to systematize the sharing at all the brands of the group, a part of the litigious customers. The judge came to follow up on this request to the watermark of the 1978 law¹ but which goes in the direction of a protection of the income of the group. The second procedural element is 2 QPC deposed by way of exception before the French supreme court. In a 2010 decision¹, Roubaix made it possible to question the interpretation of constitutional judge regarding application of the softer law retro-activity, while in a 2015 decision¹, made it possible to identify the unconstitutionality of a texte from the labour code. Here, the intervention of Roubaix exceeds its own interest to profit collectively. The company advances our understanding of society and through it, that of each employee. It can be inferred that the legal aspect is not likely to reduce shareholders' income. Only its business model, unsuited to a finite growth system, urges them to international development, which refers to examining the public health prospect.

Secondly, public health measures are imposed on customers, shareholders and human resources. Deprived of its operating resources, revenues would dry up and increase the debt, which makes the shareholder wonder about the medical component. By comparison, all listed entities, without a state contract and with a large number of employees in the West, showed an underweight of 2 to 3 times lower than the amount of the security before the beginning of 2020 with a more extensive return plateau. This means that the prospect of a new outbreak seems to point to a context unfavourable to Roubaix. In this regard, it is possible to cite the destiny of the Flunch self-service forced to separate from 39 of its canteens¹. So, to speculate on the future, it was necessary to introduce new concepts for the strategists of the big distribution; those of the immunology. First, how to apply aseptic measures to personnel for biohazard strains classified beyond P2. Second, how to maintain the supply required for the profitability objectives with respect to prohibited displacement. Finally, how to maintain the cohesion of national and international franchises in a context assimilated to a war by the Presidency of the French Republic. This is a reversal of economic doctrine in which the essential function takes a central place in investment. An ultra-local land investment, subdivided into specialized and automated swarms, seems to be a convincing solution for the speaker, who has already experienced a military invasion. The medical chapter would therefore not favour Roubaix. However, since the group is not on the stock market, it is related to a Trainer license and cannot claim to the level of highest level of verification that would allow to refine this reading whose conclusion cannot be retained for anything other than a speculative extraction.

For these reasons,

Roubaix deserves a middle high confidence.

Last tenders in Hauts-de-France ( Roubaix )

| Roubaix | AFM | Intentionally left blank, Roubaix 59100 FRANCE | Dec 1955 |

| Tourcoing | LARGE SIGNS | 4, rue Louis Armand Tourcoing 59200 FRANCE | ||||

| Roubaix | AFM | Intentionally left blank, Roubaix 59100 FRANCE | Dec 1955 |

No Comments